Autumn and the leaves are beginning to fall

For me, the Autumn months have become a time of reflection, marked by both caution and a sense of optimism. On the one hand, the evenings drawing in signal it is time to pack away the ‘t-shirt and shorts’ wardrobe of summer, to be replaced with something more substantial and protective as the temperatures drop and the rains descend. Outside, the vibrant summer garden succumbs to waterlogged grass and brown, wilting leaves. On the other hand, this should not overlook the optimism to be found in the woodland colours of an autumn walk, the chance to sit in front of a warming fire, the start of ‘The Celebrity Traitors’, as well as the (usually short-lived) hope of a new football season too.

Markets find themselves in a similar mood. Whilst there have been moments when markets have been unsettled this year, we reach autumn with equity markets returns looking in really quite fine fettle. As you can see from the table below, which is in local currency terms, double-digit returns are the norm, rather than the exception.

Pricing Spread: Bi-Bid • Price range: from 31 Dec 2024 to 30 Sep 2025

Name | Custom Period Performance |

MSCI China TR | 41.22 |

Bolsa De Madrid IBEX 35 GTR in EU | 37.61 |

FTSE MIB TR in EU | 28.59 |

MSCI Emerging Markets TR | 24.29 |

Deutsche Borse DAX 30 Performance GTR in EU | 19.95 |

Euro STOXX GTR in EU | 18.88 |

FTSE 100 TR in GB | 17.74 |

MSCI ACWI TR | 15.54 |

TSE TOPIX TR in JP | 14.88 |

S&P 500 TR in US | 14.50 |

Euronext France CAC 40 GTR in EU | 10.29 |

Source: FE Analytics

These numbers really are a triumph for the optimists, but our caution comes from market valuations moving back up towards ‘elevated’ levels, which is likely to weigh on investor returns in those most highly valued areas, particularly if volatility re-emerges. There should be some optimism to be garnered from seeing overlooked parts of the global equity market having their time in the sun, such as the UK, Europe and Emerging Markets. It will be one to watch how this broadening out of equity market returns develops, away from just the glitz and the glamour of the US technology sector, which continues to deliver an oversized amount of earnings growth.

Throw into the mix heightened geopolitical risk and uncertainty and there continues to be plenty of challenges out there that have the potential to restrain markets moving strongly forward from here, most obviously at a government level, where debt levels are high and policy making decisions are challenging.

This is all a bit doom and gloom, so for the positives. We remain in a world where corporate and household balance sheets look healthy, wages are slowing but the threat of a significant rise in unemployment looks low. Yes, much like my lawn, it looks like we have hit a soft patch but there is still a pathway forward.

The Economy: Slowing, not stalling

We have talked for some quarters about how the global economy continues to be characterised by slow growth and increasing uncertainty, and there are no notable changes to report on this count. Growth is slowing, and with that, recessionary risks are rising, but there is still plenty of evidence to suggest this is more likely to be a mid-cycle soft patch. There are areas showing resilience, but tariffs, inflation, and geopolitical risks are all creating a complex and challenging backdrop for investors alike, which demands a risk-aware approach.

There are signs that tariffs are beginning to contribute to higher consumer prices in the US, but it is still very early to assess their impact with the data at hand, and there is some evidence to suggest the impact for some countries is lower than originally considered, particularly Canada and Mexico, where increasing amounts of goods are achieving exemptions. All this highlights the uneven impact from tariff effects, and how extrapolating too far into the future all but embeds uncertainty.

Global growth is slowing, and this is keeping the outlook subdued. This deceleration is pressuring the jobs market, which is in a ‘no hiring, no firing’ phase, with much of the heavy lifting of job creation, in both the US and the UK, coming from the public sector. It looks unlikely we will see a significant rise in unemployment, but this slowing job market could ultimately result in a more cautious consumer. With consumption of both goods and services being the primary driver of US economic growth, it is worth noting that US households have been resilient in their spending despite the weakening jobs market. However, threats to this are rising. Real terms (after inflation) post-tax wage growth is slowing as prices move higher. Earlier in the year, the anticipation of upcoming tariffs appeared to boost consumer activity in the US, but that momentum is now easing as the impact of tariffs begins to take hold, and consumers can only buy so many goods at a time.

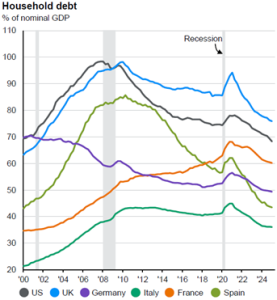

There are a couple of offsets for the household sector – overall household wealth recovered following the market disruption in April, creating a positive wealth effect, and upcoming Q1 2026 US tax refunds will provide a cash injection to households to help short term offset to this negative trend. Even in the UK and Europe, in aggregate, the consumer looks in relatively good health and strong enough to weather this cooling backdrop. With a longer-term view, consumers have, at varying levels, spent the years paying down debt since the financial crisis, impressively so for some of our southern European cousins.

Source: JP Morgan Asset Management, Guide to the Markets, 29th September 2025

Whilst there have been no notable changes on the growth outlook, the key positive factor is interest rates, where market expectations are anticipating a faster pace of rate cuts, particularly in the US. In the US, concerns about the stagnating jobs market prompted an interest rate cut in September, but also a change in expectations that there will be more cuts in relatively short order. Whilst inflation is no longer front and centre of the Fed’s concerns, surprises to the upside could have a large effect on markets. At the time of writing (late September), according to CME FedWatch, market pricing suggests an almost 90% chance of another cut in October and a 65% chance of a further cut in December too. By July next year, 75-100 basis points of cuts is a strongly suggested outcome. I am reminded of late 2023 when a disconnect emerged between market expectations for interest rates and reality, which then led to disappointment when resultant cuts did not emerge. At a time when the Federal Reserve remains under intense political pressure to cut rates, there is justified concern to support the jobs market, but if cuts continue to come and inflation remains persistent, there will be broadening concern about the dilution of central bank independence.

In the UK, inflation remains more persistent, potentially delaying further Bank of England rate cuts to next year. The Bank of England did manage to cut in August, remaining consistent in its ‘slow and steady’ pace of cuts, but is facing the challenge of a very evident amount of persistent inflation that curtails expectations of cuts coming down the line and the background of a government unwilling to tackle spending, and limited in its tax raising options. Overall, financial conditions in the UK still look well in the ‘restrictive’ rather than ‘loose’ territory.

An exorbitant privilege, or exorbitantly taking the privilege?

“Exorbitant privilege”, a term attributed to French Finance Minister d’Estaing during the 1960’s is the privilege bestowed upon the global reserve currency and the benefits it gives, such as high demand for the dollar and the lower financing costs that result, as well as a ‘flight to safety’ quality when market concerns are high.

The US dollar is the world’s reserve currency and has also been an area of focus this year, with the dollar weakening against a broad basket of currencies. The ICE US Dollar Index (or DXY) compares the US dollar against a basket of other currencies, predominantly the euro. Over the course of the year to date, the US dollar has weakened from 108.487 to 97.80, but the shape of this move is worth noting. The bulk of the decline in the DXY to date was done by April, since when it has been in a broad holding pattern overall. The only currency that is perhaps an exception has been the euro, but even here, further weakening of the dollar has been more muted.

The obvious question is, how much further this weakening cycle can go? In July, the Economist magazine published an update on its much-followed take on the Purchasing Power Parity theory, the Big Mac Index, which compares the price of the ubiquitous burger in Golden Arches around the world. If, once converted into dollars, the Big Mac prices vary, then this arguably indicates the relative expensiveness/cheapness of the currency versus the US dollar. Using this methodology, for US dollar holders, burgers still remain great value on a relative basis for thrift like ‘Big-Mac’ enthusiasts, who could have spent a summer touring Egypt, Indonesia, India and Taiwan with change to spare. Those who like to pay up for their McSpicy would have found their eyes watering at both the spice, but also in handing over all those greenbacks, whether they holidayed their taste buds in Switzerland, Norway or Sweden.

Using the same methodology, the Big Mac index implies sterling still looks on the expensive side, suggesting more room for the dollar to fall. Other forecasters, looking beyond those who measure the ingredients of highly calorific convenience foods, look less assured that strong weakening is ahead, settling around the GBP/USD level of 1.36-40 for the end of 2026.

What is the USD exposure in portfolios? We are not basing any significant portfolio decisions on the outlook for the dollar. Our concern about valuations in US equities has meant we have brought our US dollar down naturally as our allocations have drifted lower. We have also more recently sold all holdings in US government bonds across portfolios, although we had already taken the precaution of hedging the currency risk whilst in the portfolio anyway – part good fortune, part our disinclination to accept currency risk in any of our fixed income holdings as a matter of course.

We are actively thinking about our currency risk and positioning and do not discount reducing exposure further, but whilst we recognise risks of dollar weakening, we also see a challenging backdrop for sterling and the relatively low exposure to the US dollar, does mean we have already built in some mitigation of the risks from the impact of further dollar decline.

Growth and Inflation Numbers: Shifting Sands

Thanks, as ever, to our friends at Schroders for the latest consensus forecasts, which are as at 19th August 2025:

Name | GDP (%) 2025 | GDP (%) 2026 | CPI (%) 2025 | CPI (%) 2026 |

Global Economy | 2.4 | 2.3 | 2.7 | 2.5 |

China | 4.8 | 4.2 | 0.2 | 0.8 |

Emerging Markets | 3.8 | 3.7 | 3.0 | 2.8 |

US | 1.6 | 1.7 | 2.8 | 2.7 |

EU | 1.2 | 1.1 | 1.7 | 1.8 |

UK | 1.0 | 1.0 | 3.3 | 2.5 |

Source: Schroders Economic & Strategy Viewpoint, Q3 2025 (Data to 19.08.2025).

The consensus remains that we are in a low growth environment for the global economy. As challenging as the UK Chancellor has it, it is not just the UK government that is wrestling with supporting growth. In France, governments are coming and going with concerning regularity, faced with the unpopular task of trying to rein in the deficit. In China, policymakers are struggling to close the gap between a target of 5% GDP growth and a reluctant consumer, who worries more about jobs than rising prices. With stimulus of RMB500B being announced at the end of September to speed up construction projects and trigger an increase in economic activity, the Chinese government are looking at shorter-term infrastructure projects to keep growth on track and bridge the longer-term ambition of becoming a more service-orientated economy with a more developed social security framework.

Independence Matters

Central bank independence is a cornerstone of monetary policy credibility, enabling policymakers to make decisions based on economic fundamentals rather than political pressure. So, whilst President Trump’s attempt to sack one of the governors of the board of the Federal Reserve for issues surrounding a mortgage application could sound a little ‘niche’ to grab your attention, the broader market concern is that this is a first step in undermining the credibility that matters so much.

The rights and wrongs of Governor Cook’s mortgage application will be decided in the fullness of time, but this is being seen as the case that witnesses the starting gun being fired for control of the Fed’s interest rate setting body. This race could see new and existing Trump appointees becoming the dominant bloc within the ratesetting committee by next year, should Chair Powell retire as expected. With new appointee, Governor Miran, very much Trump’s man and an echo for the President’s view that interest rates need to fall sharply, in September he duly rose to the occasion with a call for an immediate 0.5% cut. Likewise, his forecast to year end, suggesting policy rates fall towards 3-3.25% has made him very much an outlier in what is an increasingly divided committee, and will help feed investor uncertainty over the coming quarters.

Portfolio Outlook

In fixed income, yields remain a key attraction, which is important given it is the primary driver of returns. There are more ways than one way to generate returns in fixed income and we broadly think of three that we can use, which are yield (the regular interest payments received by bondholders), duration (a bonds potential price change in response to interest rate fluctuations) and spreads (the increased yield received for taking on incremental credit risk). We are still positive on yields, but in portfolios we take a more cautious approach towards the other areas, which overall may lead you to conclude we are wary of the return outlook for fixed income, but this is not the case.

And that is down to the favourable conditions for yields. Whilst we can seek to manage the risk from the other areas, allowing all those attractive cash flows to drip feed into portfolios is precisely what fixed income can deliver for portfolios, where we aim for mid-single digit returns, in a defensive asset class with portfolio diversification benefits.

There is good evidence to show the primary driver of fixed income returns over the long term comes from the starting yield, so it is important to capture it whilst it is available. The evidence also shows that whilst duration can add and detract to returns, this tends to be at points of time when the interest rate cycle changes. Think 2022 for a recent example! If interest rates do fall significantly, we are unlikely to capture all the benefit, but prefer the more cautious stance given should that environment arrive, the equity part of each portfolio should find this to its liking.

Market demand for bonds has remained strong, particularly for investment grade credit, even with substantial new supply in the market. We continue to like fixed income for its yield and defensive balance against potential equity market volatility but remain wary of both interest rate risk and tight credit spreads.

Despite turbulence around tariff announcements in April, global equity markets have generally performed well this year. After years of US equity market dominance, a strong broadening out of returns is a notable feature of the year. Europe, emerging markets and even the UK have been positive contributors to portfolio returns. Within equities there remains a broad divergence – for the strongest earnings, the premium is high; for the best value, the catalyst in unlocking that remains unclear. Maintaining diversified portfolios across sectors and geographies is crucial in this environment.

Whilst there were no portfolio changes in the Core, Passive or Positive Impact portfolios during the Quarter, we did make some changes to the Offshore & Currency hedged portfolios. These were largely following the trends we implemented in the previous quarter in other models, namely reducing US government bond exposure as well as the underperforming Janus Henderson Horizon Strategic Bond. We have maintained the asset allocation at broadly the same levels, topping up existing fixed income selections and adding Artemis UK Select, an offshore version of the fund we have held in onshore models for some time.

Conclusion: More of the same, just muddling through

Whilst acutely aware of the danger of repetition, but not afraid to walk down that slippery path at least one more time, we are in a protracted period of slow economic growth. At the beginning of the year, we wrote how there were some positives and some negatives in the outlook, but there were still good reasons why portfolios could continue to move forward. We believe that this remains the case.

In portfolios, we have focused on continuing to build diversified positions and have tended to shy away from areas where valuations looked expensive, over the last few years. This may have been a headwind at times, but we maintain that in an environment such as this, receiving a series of regular cashflows into portfolios, whether it is from fixed income holdings or equity funds that deliver dividends, this helps underpin a path forward despite uncertainty on many levels very high.

We continue to expect a bumpy ride on many levels, but governments and the political world are having an oversized impact on capital markets at the current time. Below that however, corporate and household balance sheets look relatively strong. Yes, wages and jobs are coming under pressure, but there is the possibility that we are in an unsatisfactory muddle through world in which it remains possible to eke out positive returns. An uncertain world demands trying to understand more than one side of an argument and we are trying to do just that in order to steer portfolios forward.

As ever, from all of us in the investment team, Will, Emma, Amaraj, Becky, Kim, Hayley and me, we thank you for continuing to place your trust with us in managing your portfolio and we wish you all a wonderful autumn!