A Year for Prudent Optimism

The New Year is upon us—resolutions may already be wavering, but our commitment to navigating markets remains steadfast! If you are still being faithful to your resolutions – keep going!

It is generally considered a dangerous pastime to go back and look at previous investment commentaries. Standard operating procedure is to look back and feel foolish, before engaging in some serious post-event rationalisation in justifying why what you said would happen, didn’t happen, and why what actually happened turned out to be, well, all perfectly obvious after all.

Guilty as charged. We’ll move on.

Largely replenished with mince pies and lashings of turkey, the New Year is traditionally the time for optimism and for looking forward in anticipation. Thankfully, the investment picture last year was broadly settled. Fixed income and equity markets made solid returns – a short-lived tariff meltdown in April didn’t prove to be the naysayer it could have been, and overall portfolio returns looked respectable.

As in any year, there were highlights to note. A broadening out of positive returns being generated away from a very narrow section of the US mega-caps helped. Fixed income, to coin a phrase, did what it said on the tin, delivering positive returns with low volatility. Infrastructure, gold and some of our conservative multi-asset selections all turned out solid numbers too. They are all in the good books. Less so are smaller companies, which needed to be carried all year, likewise active managers tended to underperform indices (not exclusively, admittedly).

As we look forward, we remain optimistic that in the year ahead portfolios can continue moving forward. Capital investment in the tech sector remains a strong underpin, so too is the prospect of central banks continuing to cut interest rates, particularly in the UK. But we must recognise that valuations in some areas got more expensive through the year, which makes it a narrower path to navigate.

Theme for 2026? It’s a World Cup year, so it seems appropriate to go with “balancing optimism with prudence”. It’s a theme we’ll revisit (maybe) in 12 month’s time, but for now it will continue to guide our approach to markets in the year ahead.

Interest Rates and Inflation

During 2025, the balance of concern for central banks shifted away from inflation to the health of the jobs market.

Inflation continues to ease globally, but there are some countries where inflation remains persistent – in the UK, the latest data saw inflation fall more than expected to 3.2%, but still above the 2% target, albeit the expectation is for further falls through 2026. In the US where tariffs and their impact on goods prices remain a heightened risk for the inflation numbers, the risk is that the expectations of inflation falling further does not come to fruition. It is likely to be an uncomfortable first half of the year for US inflation numbers, before beginning to roll over in the middle of the year as those tariff impacts fade through time.

Turning to the job’s situation. In the UK, unemployment is drifting higher reaching 5.1% in the December release from the Office for National Statistics. Real wage growth is slowing and as UK inflation steadily becomes less of an outlier, the path is open for the Bank of England to cut policy rates as the short-term unemployment rate creeps higher than Bank’s own forecasts. In the US, labour market data have been skewed by the recent US government shutdown, which hampers interpretation. Notwithstanding the data issues, there are signs of general employment market weakness in the US, but there is also a reduced flow of migrant labour moving to the US, and some recent labour surveys have been more positive than expected. So, a soft labour market for now, and one to watch for signs of worsening.

The most recent cut in December of 0.25% from the Bank of England is expected to be followed up with more cuts in 2026. Whilst we are not economists, our sense is that the balance of opinion among economists points toward a couple more 0.25% cuts in the year ahead (with all the usual caveats applying).

It is more of a challenge to build high confidence in the direction of interest rates in the US, which is perhaps the more important side of the interest rate equation to solve. One of the impacts of rising tariffs has been a rise in goods prices – whether through tariffs themselves, or by retailers willing to push prices higher under the guise of tariff pressures – these are contributing to a higher focus on affordability in the US, which is tied into housing costs and mortgage rates (the average 30 year fixed rate mortgage interest rate is well over 6%). This background heaps more political pressure on the Federal Reserve to act in cutting rates, at a time when inflation may need a tougher hand.

In summary, while the UK appears set for further rate cuts as inflation falls, the US faces a more complex environment, balancing inflation risks with affordability and political pressures.

Do I dare mention the Budget? A handover plan.

The Chancellor delivered the government’s budget in late November, sparking the usual media frenzy and speculation – this time with an added dash of drama when the Office of Budget Responsibility prematurely released its economic forecasts before the Chancellor had even begun speaking.

The headlines: UK government spending is going to be higher in the near term than expected and taxes are going to be higher than expected in the longer term.

Spending increases appear certain, but the backloading of tax rises towards the end of this Parliament raises questions about the government’s confidence—or willingness—to implement them. Large tax rises would seem challenging for a standing government going into an election year.

Some helpful elements should not be overlooked. UK inflation has been more persistent than anyone wanted, partly driven by government policy following last year’s National Insurance and National Living Wage rises. This time round, the reduction in energy bills from April, delaying the reversal of the cut to fuel duty to next year, as well as freezing rail fares and prescription charges should provide a helpful tailwind for inflation to fall through the year ahead.

And here’s where the handover comes in. With fiscal policy stepping back, the stage is set for the Bank of England to begin reducing interest rates through 2026 as inflation subsides. Ministers will be hoping that, by the time we approach the end of this Parliament, they can unwind some of the planned tax rises—perhaps even before they take effect—in a classic pre-election ‘giveaway’.

Growth and Inflation Numbers: Scores on the doors.

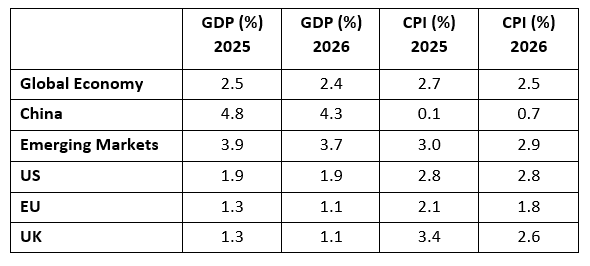

Thanks, as ever, to our friends at Schroders for the latest consensus forecasts, which are as at 10th November 2025:

Source: Schroders Economic & Strategy Viewpoint, Q4 2025 (Data to 10.11.2025)

The US is still set to grow in 2026. As we often highlight, the US consumer is key to the outlook for growth, the top 20% of households account for around 40% of spending, whereas the bottom 60% account for less than 40%. Whilst household savings rates are falling, overall household wealth, buoyed by equity markets, are rising. Though again, this is not an equal distribution – the top 50% of households control 97.5% of all US household wealth. With fiscal support for US households coming early this year in the form of super-sized tax refunds passed in the One Big Beautiful Bill Act (President Trump’s package of tax cuts passed last year), plus a tailwind from falling interest rates, the US consumer in aggregate looks in reasonable shape. There are always risks to be aware of that could upset this view, an equity market correction would create a negative wealth-effect, and policy risks are always present.

In the UK, there are no strong reasons for thinking we will be moving out of a low growth economic environment any time soon. The UK consumer is in a saving, not spending, mode. With real wages drifting lower and forecast to fall further as inflation remains elevated, a significant consumer-led recovery does not look to be immediately on the cards. Public sector spending remains a key driver, and is likely to remain so, but some more clarity following the Budget for UK corporates does at least offer some prospect of decisions being taken that could improve growth further out.

In Europe, there are some signs of optimism. The southern Europeans have enjoyed a strong 2025, Spain being a top performer, benefitting from pandemic fiscal support and positive immigration. Meanwhile, in Germany, the large stimulus package announced in 2025 may begin to positively impact the economic data. The German Federal Budget only got approved in September and whilst some of the initial defence spending went on US equipment, this is beginning to rotate to domestic defence production.

In China, if, and that should probably be capitalised, the US/China trade truce persists 2026, then it should also be a similar outlook to last year which saw lower headline levels of growth and very low inflation. China is busy diversifying its exports away from the US, with strong export growth to Africa, ASEAN and Europe, broadly offsetting far weaker exports to the US. Whilst this diversification of exports is understandable, China remains the global goods exporting country, having so far failed to light a fire under its domestic demand economy. So, for now, countries receiving Chinese goods will see their manufacturing base continue to struggle competitively but will also have an underpin of cheap goods and the deflationary pressure that brings. The domestic story in China remains anchored by a poor jobs market, weak property sector and a reluctance to grasp the necessary nettles needed to restore confidence and build domestic demand. There was some stimulus in 2025 and expecting similar support this year seems a reasonable base assumption.

Doom, Doom, Doom? Not Quite.

Blackadder Goes Forth was one of the seminal comedy series of my early teenage years. Set in the World War One trenches of France, generations of misfortune in the Baldrick clan culminates in a hapless Private Baldrick, who finds himself alongside an acerbic Captain Blackadder. In one episode, to pass some time, Baldrick shares his poetry “German Guns”, in which he mimics the relentless “Boom, Boom, Boom…” of artillery fire. Here’s a reminder.

Having talked down the UK economy earlier, there’s a danger in believing there is a relentless “Doom, Doom, Doom” of negatives pointing at the UK assets. When it comes to UK assets, we think there is still a case for a ‘glass half full’ outlook.

First, we do not ignore the headwinds. UK government debt levels are high, taxes are high, growth is low, confidence is low, and UK assets have largely been unloved by global investors since the EU Referendum in 2016. That much we know, you know, we all know.

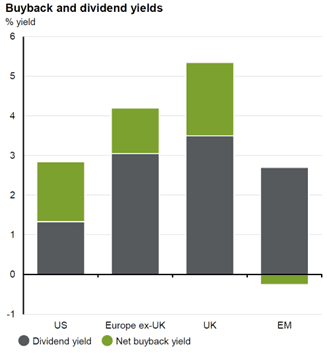

UK equities have made good returns this year with the FTSE 100 up 25.82% on a total return basis. Through the year, headline market valuations, in price/earnings terms, have moved from 11x to 13x earnings, which may push them out of the cheap to fair value aisle, but still represents a relatively attractive discount versus global peers. With a strong starting point of a dividend and buyback yield over 5% forming a helpful underpin for future returns, UK equities deserve more attention than most investors currently give them. In UK fixed income, particularly government bonds, an elevated yield over global peers coupled with what should be a helpful backdrop of falling interest rates in the nearer term, provides another strong underpin.

Source: JP Morgan Asset Management, Guide to the Markets, 17th December 2025

The challenge for UK assets remains finding the catalyst to unlock the stored value. In truth, there is unlikely to be one driver required, more a combination. Part of that combination will be reducing the abundance of caution that UK households and businesses have following a decade of economic scarring – whether it be heightened trade frictions, the uncertainty of COVID, or the damage from high interest rates and inflation. To make decisions that allow households or businesses to commit capital or borrow, requires an element of confidence and certainty. UK household savings rates remain well above long-term averages and financial insecurity is growing. At some point, we will reach the point where savings are built up and the requirement to save as much reduces, but we are not there yet. For business, we are the other side of a Budget that was less punitive than in 2024, which is a positive of sorts.

For both businesses and households, Bank of England interest rate cuts will be a helpful tailwind. Meanwhile UK assets continue to deliver attractive levels of income amidst valuations that look relatively attractive versus global peers. Private equity has been busy buying UK listed assets at a big premium to their listed valuations, highlighting the value out there.

Viewed through a lens of compelling value and dependable income, UK assets merit a place in diversified portfolios. They do not offer the glamour of high-growth US tech, but they bring attractive yields and valuations. For patient investors willing to look beyond the “Doom, Doom, Doom,” the opportunity remains.

Portfolio Outlook

Equity Markets – Moving forward, but higher valuations mean we are moving along a narrower path than we have been used to.

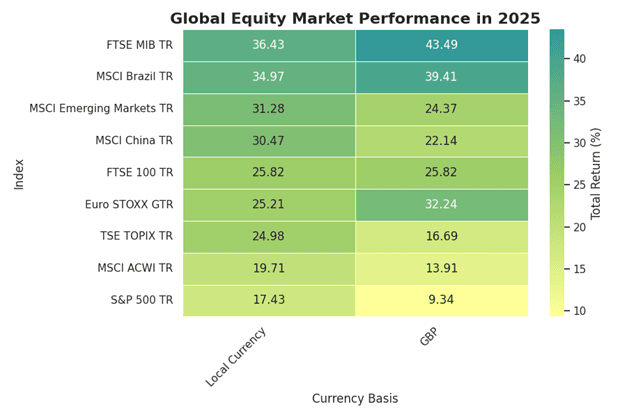

Through the course of last year, equity markets made progress and investors benefitted from a broad rise of global equity markets. The chart shows calendar year returns in both local currency, but also taking into account currency movements. The good news is equities provided a year of solid returns in 2025, broadly offering double-digit gains over the year in local currency terms, although the weak US dollar took the shine off US equities for UK investors, when currency translation was considered.

Source: Data provided by FE Analytics, chart generated by Microsoft Copilot

Within equities, whilst some of the longer-term trends remain in favour, such as US mega-cap equities, there has also been a notable broadening out on several levels. Earnings growth broadened out away from the narrow tech sector for instance. Since 2023, in the US, there has been little comparative earnings growth away from those US mega-cap tech companies, but 2025 and forecast earnings for 2026 show two things. First, whilst the pace of earnings growth from US mega-cap tech remains strong, it is on a declining trend, and importantly, earnings growth in the rest of the market has started to accelerate.

Whilst there was earnings growth in the US and emerging markets, 2025 was a year when equity valuations got more expensive. There are still some areas of relative value and we strongly believe diversification remains critical to manage concentration risk in the US as well as high valuations. There are areas which we feel warrant a strong part of a diversified portfolio. Asia, emerging markets, infrastructure and the UK all help to dilute valuation risk from those mega-cap US stocks. Emerging markets have benefitted from earnings growth, a weak US dollar and an improved outlook in China and these are tailwinds that make us feel more positive on the region than we have for some time. There have been some areas we have been far too early on, such as US smaller companies, but perhaps in the final quarter of last year there were signs of improvement. Likewise UK smaller companies, just look outright cheap for the patient investor.

In summary, certain parts of the equity markets feature highly successful, cash-generating businesses, but with expensive valuations, while others offer clear value but still lack a catalyst to unlock it. Over the long-term, it makes sense to hold a measure of both, hence our policy of having well diversified portfolios and not trying to time mean-reversion in markets. We continue to believe that maintaining diversified portfolios across sectors and geographies is crucial in this environment.

Fixed Income – still attractive income, with returns set to be boosted by rate cuts.

It has been a while since 2022, but the reset of that year and the deeply painful losses that ensued still reverberate for fixed income investors. 2022 was the worst annual year for fixed income returns since the early 1990’s, but the reset in yields that happened as interest rates rose, re-established fixed income as an attractive asset class.

Thankfully, 2025 turned out to be a year when fixed income investors got what they wanted, namely a solid level of income without much volatility, coupled with some helpful portfolio diversification benefits. Today, the headline levels of yield that fixed income offers remain attractive, so it is important to take advantage of it whilst available. Given the bulk of the return from fixed income comes from the starting yield, going into 2026 holding a series of fixed income funds with a distribution yield around 5% offers the prospect of another year of solid returns from the asset class. If interest rates do drift lower, as is widely anticipated, then this already solid foundation should be boosted further as bond prices rise as interest rates fall.

There is always a ‘but’…As we said last quarter, there are more ways than one way to generate returns in fixed income. First, there is the yield (the regular interest payments received by bondholders), second, benefitting from the movement in interest rates (also known as duration and is when a bonds price changes in response to interest rate fluctuations) and, finally, in spreads (the increased yield that can be received for taking on incremental credit risk).

We have already shown our hand and said we are positive on yields. Taking the other two levers, there are reasons for some more caution and duration risk in portfolios has drifted lower during 2025, which is a position we are comfortable with. Credit risk is present, of course, but holding some government bonds helps mitigate the risk of losses if credit spreads widen. Again, we are comfortable with this, but are also aware that developed market governments have been happy to run fiscal deficits at elevated levels – this is an issue we keep a close eye on.

Conclusion: Time to go again.

If Celebrity Traitors was the jewel of the televisual crown in 2025, then hopefully The Traitors Season 4 has got us off to an entertaining start to the New Year. Markets tend to deliver periods when they appear to be more traitor than faithful, to the hopes, dreams and aspirations we individually invest for. It is worth remembering that they do tend to be faithful over the long-term, despite the size and scale of the trap doors which are inevitably encountered along the way.

The economic backdrop continues to look reasonable. Less ‘spectacular’, more just ‘solid’ for adequate phrasing, but that is rarely a bad starting point. Consumers still look well positioned in the developed world too, albeit wage growth in real terms is falling, and the jobs market will need watching closely. Household balance sheets, in aggregate, look ok with household debt on a downward path and, in the UK at least, savings rates remain elevated. Companies and households will both benefit from interest rates that are likely to be falling through 2026.

Both equity and fixed income markets have positives and negatives attached to them. Certain segments feature highly successful, cash-generating businesses but have expensive valuations, while others offer clear value that remains unrealised but still a lack of a catalyst to unlock it. Over the long-term, it makes sense to hold a measure of both, hence our policy of having well diversified portfolios and not trying to time mean-reversion in markets.

Fixed income looks very attractive from a yield perspective, particularly if interest rates do fall. Taking advantage of that consistent income stream and allowing those cashflows to drip into portfolios continues to feel like a sound strategy.

As ever, from all of us in the investment team, Will, Amaraj, Becky, Kim, Hayley and me, we thank you for continuing to place your trust with us in managing your portfolio. May we also take the opportunity to wish you a wonderful year ahead!