On the surface, the only thing seemingly more in demand than gold right now is a Radiohead ticket, so it is unsurprising to see the gold price reaching another recent record.

Whilst this is intended to be a short piece, it is sensible to set the background for some of the broad themes that have been underpinning the rise in the gold market. These broad themes have been:

- Increased central bank purchases of gold following the freezing of Russian assets after its invasion of Ukraine. This spurred a demand from central banks, led by China, Turkey, India, and also Poland that has ambitions to achieve a 30% reserves allocation to gold.

- Chinese household demand for gold has been high in terms of jewellery, bars and coins as an alternative store of value given the weakness of the property sector where much of Chinese household wealth has been invested.

- Heightened geopolitical risk has pushed investors to the precious metal as a potential shield against trade wars and a destabilised world, as countries attempt to stop the dollar being used as a geopolitical weapon.

These more recent themes are not to ignore traditional tailwinds that are usually helpful conditions for gold price, namely inflation and a weakening US dollar.

Why is the price rising?

Demand has been high: Demand has been coming from two sources. The official sector and from investors.

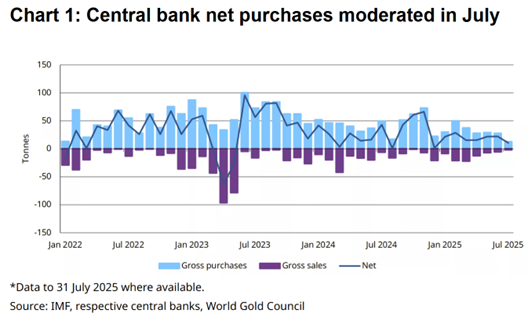

The official sector, which includes central banks, have almost exclusively been net buyers of gold over the last three years with an exception only for a few short months in the first half of 2023. According to World Gold Council data, global central banks added over 1000 tonnes of gold to their reserves in 2024. Whilst this has been a very strong source of demand, the strength of that demand has been waning this year, with net demand still positive but far more muted than the last couple of years. With central bank demand drifting back to lower levels, it is reasonable to question whether official sector buying is strong enough to continue to push the gold price higher.

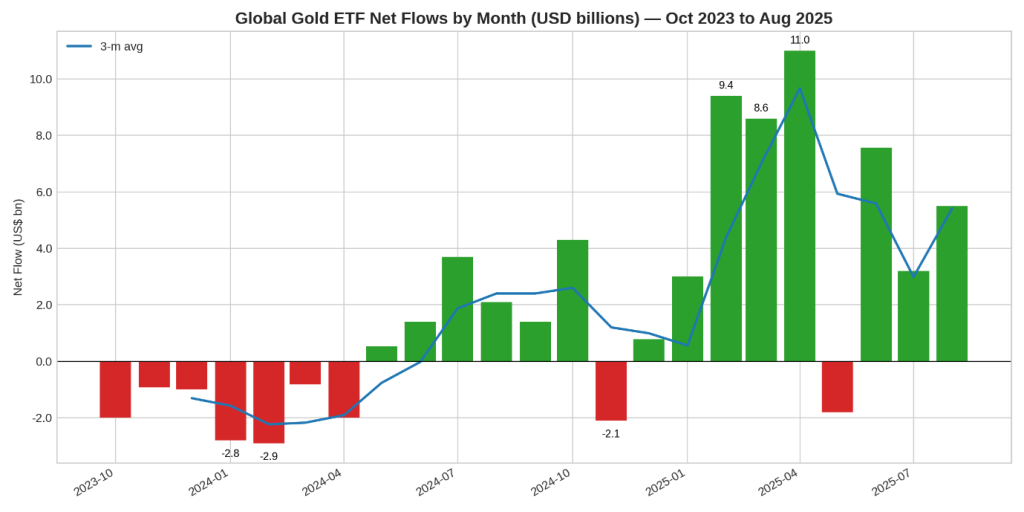

Meanwhile, investors have also been clamouring to buy and have been a strong source of demand at the point at which central bank demand has lessened. An example of this is gold ETF flows, which are currently the second strongest on record with a year-to-date inflow of $47bn up to the end of August.

Source: World Gold Council, Gold ETF Flows. Chart prepared by Co-Pilot

Climbing up the Walls

“Climbing up the wall of worry” is an investment phrase saying that describes how markets can still creep forward despite a negative backdrop. Gold, perhaps, feeds off it.

Feeding into this fear is the market expectation that a slowing economy and a poor jobs market is going to precipitate deeper interest rate cuts than expected. In recent weeks, markets have increasingly been pricing in interest rate cuts, particularly coming from the US Federal Reserve as weak labour data encouraged traders to price a high pace of cuts. At the time of writing (late September), according to CME FedWatch, market pricing suggests an almost 90% chance of another cut in October and a 65% chance of a further cut in December too. By July next year, 75-100 basis points of cuts is a strongly suggested outcome.

This is favourable for gold in two ways. First, it reduces the opportunity cost of holding gold, which doesn’t have any income stream in comparison to many other assets. Second, history suggests that gold finds favour in environments when interest rates are being lowered, because that suggests a period when economies are weak and therefore demand is higher for traditional safe-haven assets.

We are in unsettled times

How about portfolios?

First, why do we hold some gold? It is less for inflation proofing, and more for two reasons. First, to protect from geopolitical risk and second, to protect from a weak US dollar. A severely weaker dollar that could precipitate out of a dilution of Fed independence, would be a support for gold moving quite a bit higher. Couple to that no near- term resolution to any of the global geopolitical hotspots (Ukraine, Iran, Gaza), and ongoing geopolitical tensions are likely to feed investor demand for gold and its safe haven status. When the path of least resistance is for prices to move higher, sometimes it is best not to stand in the way.

However, gold has doubled in price over the last five years, so with no valuation method to value gold (it has no income to assess some relative value), we are wary of extrapolating the last five years and carrying it forward into future expectations. We also acknowledge that reliance on particularly large buyers, in both the official and investment sectors introduces risk, as any sudden reduction in their purchases could place pressure on the price and add an element of unpredictability.

While the prospect of US interest rate cuts is generally supportive for gold, central bank purchases have eased this year compared with recent years. Given this shift, we view gold as a useful portfolio diversifier but would exercise some caution before adding further exposure. That said, it is not yet time to hit the exit button either.